TSM vs EU standards represent one of the most critical decisions facing pharmaceutical manufacturers today. The choice between these competing standards can make or break your manufacturing operations, with billions of dollars in tablet production hanging in the balance. Understanding TSM vs EU standards isn’t just technical knowledge—it’s strategic business intelligence that determines your competitive position in global markets.

This comprehensive guide reveals everything global manufacturers need to know about TSM versus EU standards, from technical specifications to implementation strategies that can save your operation millions while ensuring regulatory compliance.

Executive Summary: The Strategic Decision Framework

When facing the choice between TSM and EU standards, manufacturers should choose TSM standards if they operate primarily in North American markets, have existing equipment following TSM specifications, work predominantly with US-based pharmaceutical companies, or focus their regulatory compliance on FDA requirements. Conversely, EU standards make more sense for manufacturing intended for global markets, operations seeking optimal production efficiency, facilities planning new investments, or companies prioritizing equipment longevity and reduced wear.

The performance differences between these standards are significant. TSM standards remain exclusive to the United States, while EU standards serve as the worldwide standard. TSM features an angled head profile with 37 degrees for B-tooling, whereas EU standards use a domed profile with 30 degrees for B-tooling. This seemingly small difference leads to higher machine wear with TSM due to angular contact, compared to lower wear with EU standards thanks to smooth flow characteristics. Production speeds also differ, with EU standards offering 20 to 25 percent higher productivity potential compared to TSM’s standard efficiency. Equipment costs favor TSM initially with lower investment requirements, but EU standards provide better lifecycle value despite higher upfront costs. The regulatory landscape shows TSM governed by the American Pharmacists Association, while EU standards follow ISO-based frameworks without a single governing authority.

Historical Development: Two Paths to Pharmaceutical Excellence

The American Journey: From IPT to TSM

The story begins in the early 1900s when pharmaceutical manufacturing was becoming industrialized. Major companies like Upjohn, Smith Kline French, and Winthrop recognized the need for standardized tooling specifications to ensure consistent tablet quality across the growing industry.

Working with the American Pharmaceutical Association, these pioneers created the Industrial Pharmaceutical Technology Standards Manual, which represented the first comprehensive guide for tablet compression tooling. When IPT was dissolved, the manual evolved into what we know today as the Tablet Specification Manual, now in its seventh edition.

The TSM standards were born from practical necessity, focusing on protecting companies’ substantial tooling investments while maintaining established manufacturing processes. This American standard became the foundation for US pharmaceutical manufacturing, creating a locked-in ecosystem that persists today. The development reflected the rapid expansion of the American pharmaceutical industry in the mid-20th century, when companies needed standardized approaches to manage their growing production requirements.

The European Evolution: Global Standardization

Meanwhile, across the Atlantic, European manufacturers were developing their own approach based on a different philosophy centered on global interoperability and optimization for modern, high-speed manufacturing. The European standard, often called Euronorm or EU standard, emerged from this fundamentally different approach to standardization.

Unlike TSM, the EU standard isn’t governed by a single organization. Instead, it has been adopted by ISO and most tablet press manufacturers worldwide, making it the de facto global standard outside North America. This distributed governance model has allowed the EU standard to evolve more rapidly in response to technological advances and manufacturing innovations.

The EU standard’s development coincided with the rise of high-speed tablet presses, leading to design optimizations that TSM standards later attempted to incorporate through modifications like the “domed TSM head.” This timing advantage gave EU standards a technological edge that continues to influence manufacturing efficiency today.

Technical Specifications Deep Dive

Punch Head Configurations: The Critical Difference

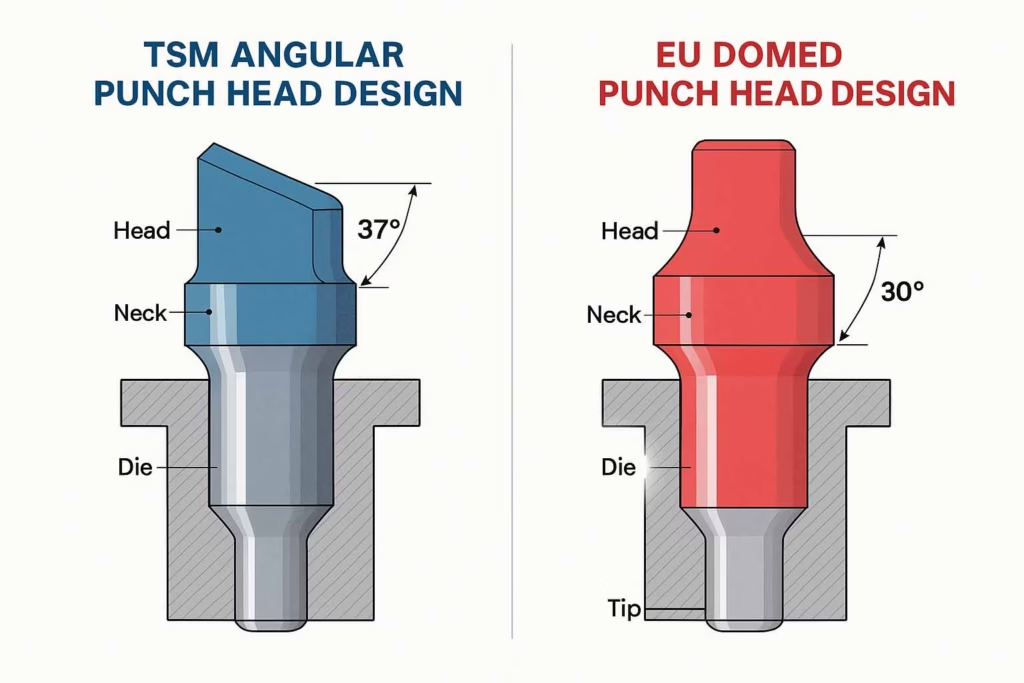

The most significant difference between TSM and EU standards lies in punch head design, a seemingly small detail that profoundly impacts manufacturing performance. The TSM head profile features an angular top profile with sharp transitions, creating an inside head angle of 37 degrees for B-type tooling. This design results in greater overall head thickness and a standard dwell flat diameter of 0.367 inches in practice, with a travel distance of 0.4375 inches for standard heads.

In contrast, the EU head profile uses a domed design with smooth radius transitions, creating an inside head angle of 30 degrees for B-type tooling. This design philosophy emphasizes optimization for reduced thickness while providing a larger effective dwell flat diameter of 0.375 inches, optimized for smoother roller contact that enhances manufacturing performance.

Dimensional Specifications and Their Impact

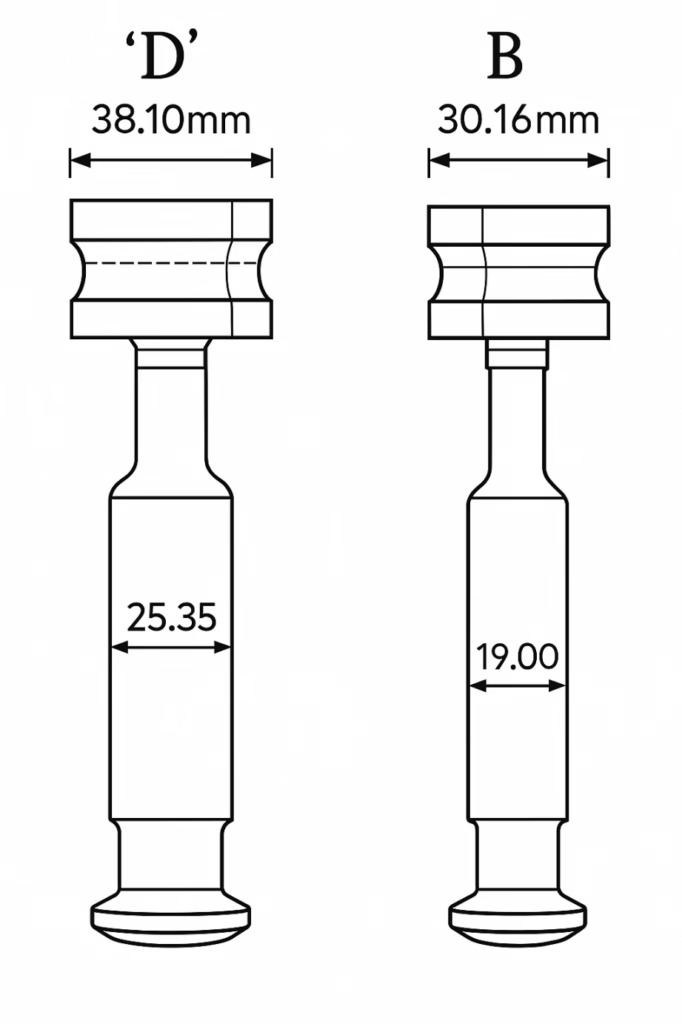

The dimensional differences between these standards extend beyond head profiles to affect overall manufacturing compatibility and performance. TSM standards feature shorter overall punch lengths, being 0.010 inches less than EU standards, which creates significant compatibility issues between systems. The head thickness remains greater in both B and D configurations for TSM tooling specifications compared to EU specifications, affecting dwell time and manufacturing efficiency.

Both standards maintain compatible barrel diameters, with B tooling using 19mm diameter and D tooling using 25.4mm diameter. However, the overall punch length differences mean that EU standard punches cannot be used in TSM tablet presses, while TSM punches are incompatible with European equipment without significant modifications.

Tooling Classifications: Understanding B and D Systems

Both standards use similar classification systems that divide tooling into B and D categories. B tooling, also known as TSM19 or EU19, accommodates tablets up to 16mm in diameter and allows for higher station density, making it possible to achieve 20 to 25 percent more stations than D tooling. This configuration is ideal for small to medium tablets and high-volume production scenarios, offering superior productivity for batch manufacturing operations.

D tooling, referred to as TSM1 or EU1, supports tablets up to 25mm and larger, providing greater structural integrity necessary for large tablet production. This category offers better durability when working with difficult-to-compress materials and is essential for specialized formulations that require larger tablet sizes. The choice between B and D tooling primarily depends on tablet size requirements and production volume considerations rather than the underlying TSM or EU standard selection.

Manufacturing Impact Analysis

Production Efficiency Implications

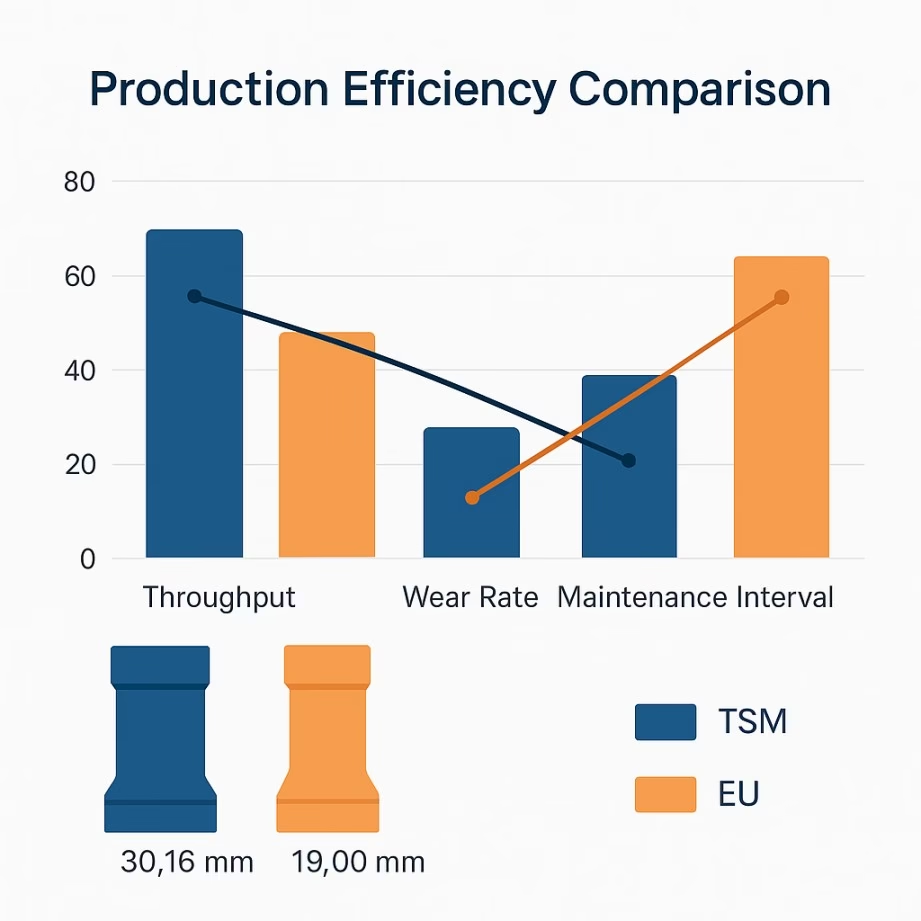

The choice between TSM and EU standards directly impacts manufacturing efficiency through several critical factors that affect both productivity and profitability. The dwell time optimization represents one of the most significant performance differentiators between these standards.

EU standards demonstrate clear advantages in dwell time optimization due to the domed head profile that creates smoother transitions over compression rollers. This design results in extended contact time that enables more effective powder compaction, reduced stress concentration that minimizes heat generation and tool wear, and higher speed capability that maintains quality at increased production rates. The smooth roller contact characteristic of EU standards allows manufacturers to operate at higher turret speeds while maintaining the same quality standards that would require slower operation with TSM tooling.

TSM standards face limitations due to their angular profiles that create impact stress during operation. This leads to work hardening where repeated roller impacts create hardened surface layers on the punch heads. Over time, this results in premature wear, scarring, and pitting that eventually renders punches unusable. These characteristics necessitate speed restrictions to maintain quality, limiting the overall productivity potential of TSM-based systems.

Machine Wear and Maintenance Considerations

The wear characteristics and maintenance requirements differ substantially between TSM and EU standards, with significant implications for operational costs and downtime. EU standards demonstrate superior performance in wear reduction due to their smoother operation profile. The domed punch heads reduce mechanical stress during operation, typically extending tool life by 15 to 30 percent compared to TSM tooling. This translates to longer service intervals and reduced downtime for tool replacement, creating measurable operational advantages.

TSM standards require more intensive maintenance due to the angular impact stress that accelerates wear patterns. The sharp transitions in TSM head profiles create stress concentration points that lead to faster degradation of critical surfaces. This results in higher replacement frequency for tooling components, increased downtime for maintenance activities, and higher overall maintenance costs due to the premium required for maintaining sharp angles and precise dimensions.

The maintenance impact extends beyond just tool replacement to include related systems and components. EU standards’ smoother operation reduces stress on tablet press mechanisms, leading to longer intervals between major maintenance events and reduced wear on compression rollers, cams, and other mechanical components.

Quality Control Differences

The quality characteristics of tablets produced under TSM versus EU standards show measurable differences that impact both product quality and manufacturing efficiency. EU standards generally produce more consistent results due to uniform compression achieved through smooth dwell transitions that ensure even powder compaction throughout each tablet. This consistency extends to better weight control, as the extended contact time improves dose uniformity, and reduced defect rates, particularly lower incidences of capping and lamination that can plague tablet production.

Surface finish quality represents another area where EU standards typically excel. The smooth tool surfaces produced through the domed head design and reduced wear characteristics result in superior tablet surface finishes. TSM standards may show more variation in surface quality due to the tool wear patterns associated with angular head profiles and the work hardening that occurs over time.

These quality differences have implications beyond just aesthetic considerations. Consistent tablet quality reduces the need for rework and reprocessing, improving overall equipment effectiveness and reducing waste. The improved surface finishes associated with EU standards can also enhance coating operations and final product appearance, important considerations for commercial pharmaceutical products.

Global Implementation Landscape

Regional Adoption Patterns

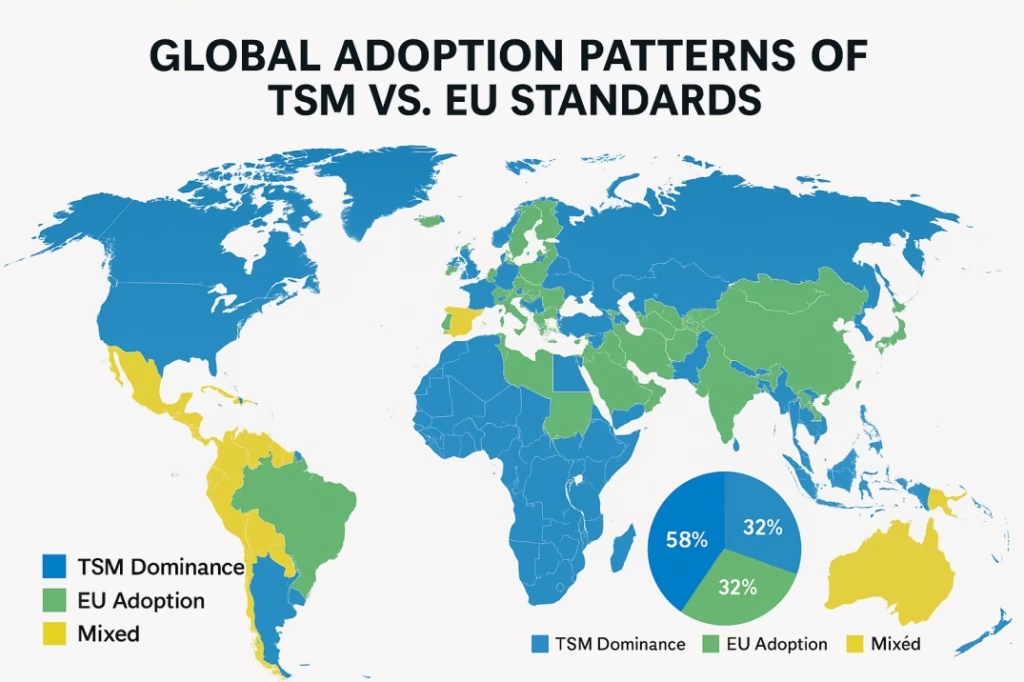

The adoption of TSM versus EU standards follows clear regional patterns that reflect historical development, regulatory frameworks, and industrial relationships. North America maintains TSM dominance with over 95 percent of US pharmaceutical manufacturing utilizing TSM specifications. This dominance stems from FDA familiarity with TSM specifications, massive industry inertia created by the extensive installed base, and an established supply chain featuring an extensive TSM tooling supplier network.

European markets demonstrate EU standard leadership with approximately 85 percent of European pharmaceutical production following EU specifications. This adoption pattern reflects regulatory framework harmonization with EU pharmaceutical directives, innovation focus on leading development in high-speed manufacturing, and global influence that has made EU standards the default choice for most international manufacturers.

The Asia-Pacific region shows mixed adoption patterns that often depend on when facilities were established and their target markets. Emerging markets tend toward EU standards for new facilities, seeking global compatibility and access to the latest manufacturing technologies. Established markets like Japan use modified standards that blend elements of both approaches, while China shows mixed adoption depending on the target market for production output.

The rest of the world predominantly favors EU standards, with Latin America, Africa, and the Middle East showing strong preference for EU standards in new pharmaceutical investments. This global trend toward EU standards reflects the desire for international compatibility and access to global supply chains.

Regulatory Compliance Landscape

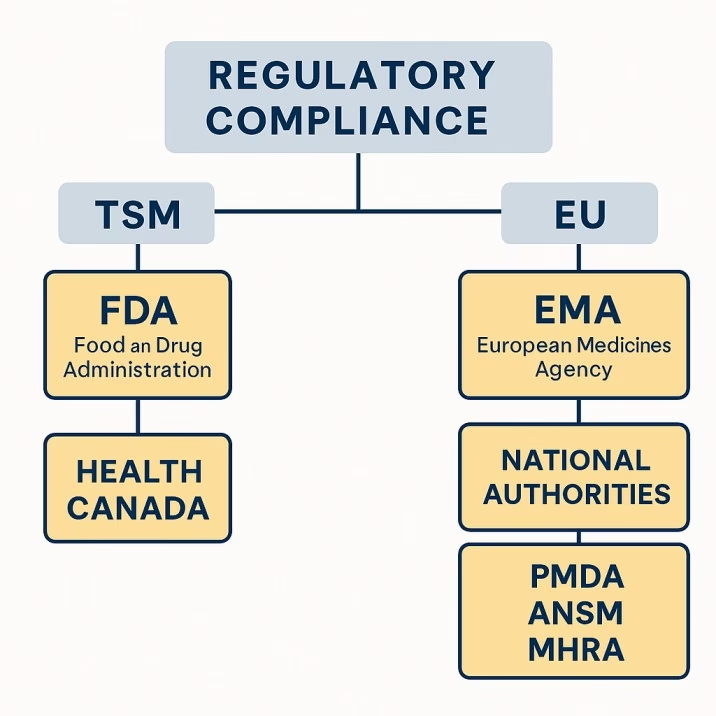

The regulatory environment surrounding TSM and EU standards creates important considerations for manufacturers operating in different jurisdictions. FDA and US regulations provide explicit acknowledgment of TSM specifications within pharmaceutical guidelines, creating established protocols for TSM equipment validation and well-defined change control procedures for companies considering standard switches. The integration of TSM standards into US cGMP requirements means that switching standards requires extensive documentation and regulatory submissions.

European Medicines Agency frameworks show natural compatibility with EU standards, supporting harmonization efforts that push toward global standardization initiatives. EU standards integrate seamlessly with European pharmaceutical manufacturing requirements and gain international acceptance for pharmaceutical exports. This regulatory alignment provides advantages for companies seeking to manufacture products for global distribution.

International harmonization efforts through ICH guidelines are moving toward unified international standards, with WHO initiatives supporting developing countries in standard selection decisions. The emergence of ISO 18084 as a potential unified global standard reflects industry pressure from multinational companies driving standardization efforts. These trends suggest a gradual movement toward greater standardization, though the timeline for such changes remains uncertain.

Economic Analysis: Investment and ROI Considerations

Initial Investment Comparison

The initial investment requirements differ significantly between TSM and EU standard implementations, though the long-term economic implications often favor EU standards despite higher upfront costs. TSM implementation typically requires equipment investments ranging from $200,000 to $2 million per tablet press unit, with tooling inventory representing an additional $50,000 to $200,000 initial investment. Maintenance equipment adds another $25,000 to $75,000 to the initial setup costs.

Training and validation costs for TSM implementations include personnel training costs of $15,000 to $40,000, process validation expenses of $50,000 to $150,000, and regulatory submission costs ranging from $25,000 to $100,000. These costs reflect the established nature of TSM systems and the extensive documentation and processes available for implementation.

EU implementations command a premium of approximately 10 to 15 percent for equivalent equipment, with tablet presses ranging from $250,000 to $2.5 million per unit. Tooling inventory costs range from $60,000 to $250,000, while maintenance equipment requires $30,000 to $85,000 initial investment. The higher costs reflect the more advanced technology typically associated with EU standard equipment and the global supply chain considerations.

Training and validation costs for EU systems are correspondingly higher, with personnel training costs of $20,000 to $50,000 reflecting the greater complexity of modern EU standard systems. Process validation costs range from $60,000 to $175,000, while regulatory submissions can cost $30,000 to $125,000, reflecting the additional complexity of international regulatory coordination.

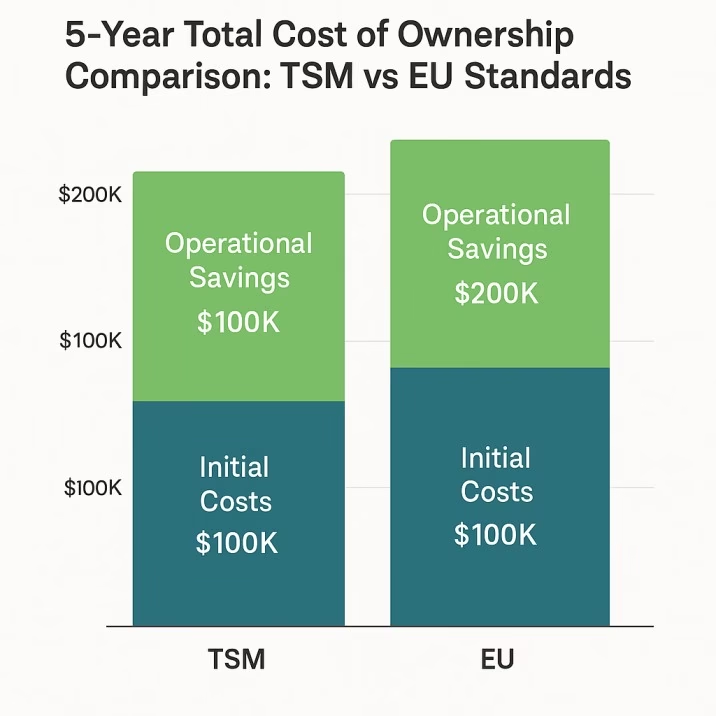

Total Cost of Ownership Analysis

A comprehensive five-year total cost of ownership analysis reveals that while EU standards require higher initial investment, operational savings typically achieve break-even within five years, with significant advantages thereafter. Initial equipment costs show EU standards at a 10 percent disadvantage, but this difference is offset by substantial operational savings.

Tooling replacement costs favor EU standards by approximately 31 percent over five years due to extended tool life and reduced wear characteristics. Maintenance labor costs show a 26 percent advantage for EU standards, reflecting the reduced maintenance requirements and smoother operation characteristics. Downtime costs present the most significant difference, with EU standards showing a 43 percent advantage due to reduced maintenance frequency and more reliable operation.

Energy consumption also favors EU standards by approximately 16 percent, reflecting the efficiency improvements associated with smoother operation and reduced mechanical stress. When all factors are considered over a five-year period, the total cost of ownership reaches approximate parity, with EU standards showing slight advantages that increase over longer time horizons.

Productivity and Revenue Impact

The productivity differences between TSM and EU standards translate directly into revenue implications for manufacturing operations. EU standards typically enable 20 to 25 percent higher throughput potential compared to TSM standards’ baseline performance. For medium-scale operations, this productivity advantage can represent annual revenue increases of $200,000 to $500,000, making the standard choice a significant strategic decision.

Quality cost reduction represents another important economic consideration. EU standards typically demonstrate 15 to 20 percent fewer defective tablets compared to TSM standards, directly improving manufacturing yields and reducing waste costs. Improved yields result from better powder compaction characteristics that increase successful batch rates, while the regulatory confidence gained from consistent quality reduces validation costs and regulatory risk.

Technology Trends and Future Outlook

Industry Standardization Movement

The pharmaceutical manufacturing industry is experiencing unprecedented pressure for global standardization, driven by several converging forces that are reshaping how manufacturers approach standard selection. Globalization has created demand from multinational companies for compatible equipment across facilities, enabling more flexible production planning and reducing complexity in managing global operations.

Supply chain optimization drives the need for standardized tooling to reduce inventory complexity and enable more efficient parts management across multiple facilities. Regulatory harmonization efforts by international agencies create pressure for unified standards that can streamline approval processes and reduce regulatory burden. Cost pressures from increasing competition demand manufacturing efficiency improvements that can be achieved through standardization.

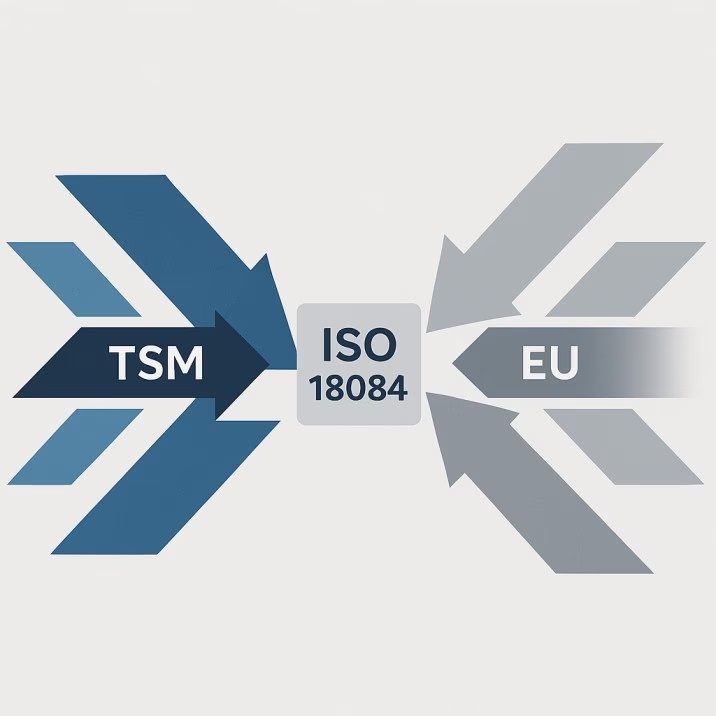

ISO 18084: The Emerging Unified Standard

The International Organization for Standardization has developed ISO 18084 as a potential bridge between TSM and EU standards, incorporating best practices from both existing standards while addressing compatibility issues that currently limit interchangeability. This emerging standard provides a framework for gradual industry transition and supports both existing and new manufacturing facilities.

The adoption timeline for ISO 18084 suggests early adopters will emerge in new facility construction between 2025 and 2027, followed by broader industry adoption for major upgrades between 2027 and 2030. Beyond 2030, there may be a potential phase-out of legacy standards for new equipment, though existing installations will likely continue operating under current standards for many years.

Technological Innovations Impacting Standards

Advanced manufacturing technologies are beginning to influence how standards are implemented and their relative importance for manufacturing operations. Continuous manufacturing may require new standard considerations as the industry moves away from batch processing toward continuous production methods. AI-optimized production systems could potentially bridge standard differences by automatically adjusting parameters to optimize performance regardless of the underlying standard.

Three-dimensional printing integration for custom tooling could reduce some of the current constraints associated with standard selection, while IoT monitoring enables real-time performance optimization that can maximize efficiency regardless of the chosen standard. These technological advances suggest that while standard selection remains important today, future innovations may reduce the significance of this choice.

Precision manufacturing demands are pushing both standards toward tighter tolerances, with plus or minus 0.1mm becoming standard for critical dimensions. Advanced materials including tool coatings and composites are extending tool life for both standards, while smart tooling with embedded sensors enables predictive maintenance capabilities. Automated changeover systems are reducing downtime between different products, improving overall equipment effectiveness regardless of standard choice.

Practical Decision Framework

New Facility Planning: Strategic Considerations

When establishing new pharmaceutical manufacturing capabilities, the standard choice becomes a strategic decision with implications lasting 20 to 30 years. Market access requirements represent a critical consideration in this decision process. Companies pursuing global market strategies should typically choose EU standards for worldwide distribution capability, considering regulatory approval timelines in target markets and evaluating export requirements and international partnership opportunities.

Regional focus strategies may justify TSM standards for operations concentrating on North American markets, though companies should consider future expansion possibilities and analyze supply chain localization benefits. The geographic scope of market access requirements often determines the optimal standard choice more than purely technical considerations.

Technology platform decisions significantly impact long-term operational capabilities. EU standards typically provide access to the latest high-speed technology and manufacturing innovations, while TSM standards offer mature technology with proven reliability and extensive support networks. Some companies consider hybrid approaches with separate lines for different markets, though this significantly increases complexity and operational costs.

Supplier relationship management becomes crucial for long-term success regardless of standard choice. Companies should evaluate long-term equipment supplier partnerships, consider maintenance and support capabilities, and analyze tooling supply chain reliability. The strength and stability of supplier relationships often matter more than minor technical differences between standards.

Migration Strategies for Existing Operations

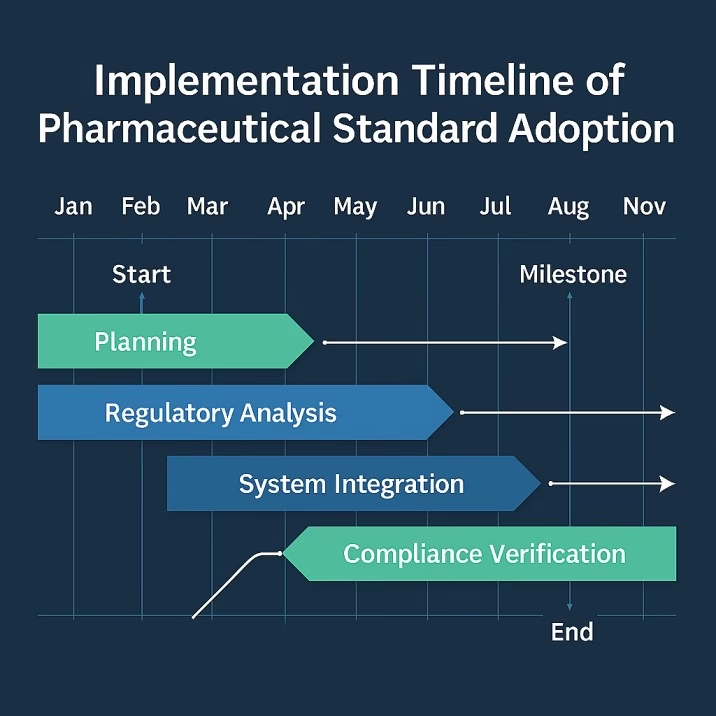

Facilities considering standard migration should adopt a systematic approach that minimizes risk while capturing the benefits of improved standards. The gradual transition approach typically works best for existing operations, beginning with a comprehensive assessment phase lasting three to six months that includes thorough equipment audit, cost-benefit analysis for each production line, regulatory impact assessment, and staff training requirement evaluation.

The pilot implementation phase, lasting six to twelve months, involves converting a single production line for proof-of-concept, validating quality equivalence, training maintenance personnel, and establishing new supplier relationships. This approach allows companies to understand the practical implications of standard migration before committing to facility-wide changes.

Full migration typically requires one to three years, involving systematic line conversion during scheduled upgrades, maintaining parallel capability during transition, completing comprehensive staff retraining programs, and updating all documentation and procedures. The extended timeline allows for careful management of risks and thorough validation of changes.

Risk mitigation strategies should address supply chain security by maintaining dual-source capability during transition, establishing emergency tooling inventory, developing supplier qualification procedures, and creating backup manufacturing plans. Quality assurance requires extensive comparability studies, regulatory authority engagement, customer notification and approval processes, and enhanced monitoring during transition periods.

Vendor Evaluation Guidelines

Selecting equipment suppliers requires different evaluation criteria depending on the chosen standard. TSM standard suppliers should be evaluated based on FDA registration and cGMP compliance history, North American service network coverage, tooling inventory and delivery capabilities, and integration capabilities with existing quality systems. Companies should focus on established US manufacturers with proven FDA track records and extensive experience with US regulatory requirements.

EU standard suppliers require evaluation based on global service capability and support, innovation pipeline and R&D investment, regulatory compliance across multiple jurisdictions, and technology advancement and upgrade pathways. Companies should prioritize manufacturers with strong European presence and global reach, as these suppliers typically offer access to the latest manufacturing technologies and innovations.

Implementation Timeline Templates

New Facility Implementation

New facility implementation typically requires 18 to 24 months regardless of standard choice, though EU standards may require slightly longer timelines due to additional complexity. The design and engineering phase lasts four to six months, with TSM following standard processes while EU implementations may involve additional complexity requiring longer design periods. Early regulatory pre-approval often determines success regardless of chosen standard.

Equipment procurement typically requires six to eight months, with TSM procurement often completed in six months while EU procurement may require eight months due to global supply chain considerations. Supplier qualification becomes critical during this phase, often determining overall project success more than standard choice.

Installation and testing phases last three to four months, with TSM installations typically completed in three months while EU installations may require four months due to greater system complexity. Staff training should overlap with installation activities to minimize overall timeline impact and ensure smooth transition to commercial production.

Validation and startup activities require three to four months, with TSM following standard validation approaches while EU standards may require extended validation due to international regulatory requirements. Quality system integration often determines the success of this phase regardless of standard choice.

Commercial production ramp-up typically requires two to three months, with TSM systems often achieving faster initial ramp-up while EU systems may require gradual optimization to achieve full performance potential. Performance monitoring becomes critical during this phase to ensure systems meet design specifications.

Conversion Project Timeline

Conversion projects typically require 12 to 18 months, beginning with planning and assessment activities lasting two to three months. This phase includes detailed cost-benefit analysis and stakeholder alignment activities that determine project success. Risk mitigation planning during this phase often determines overall project outcomes.

Regulatory preparation requires three to four months, focusing on authority engagement and change control documentation. This phase often determines regulatory acceptance of changes and should include comprehensive documentation of equivalence studies and change justifications.

Equipment modification activities last four to six months, involving line-by-line conversion while maintaining parallel capability. This phase requires careful coordination to minimize production disruption and maintain product supply throughout the transition period.

Validation and testing require two to three months, focusing on comparability studies and quality equivalence proof. This phase determines regulatory acceptance of changes and should include comprehensive documentation of product quality equivalence.

Commercial transition typically requires one to two months, involving gradual volume transfer and performance monitoring. Success during this phase depends on thorough preparation during earlier phases and comprehensive staff training.

Quality Management and Regulatory Compliance

Validation Requirements by Standard

TSM standard validation follows established FDA guidelines with well-defined documentation requirements including equipment qualification following FDA guidelines, process validation per 21 CFR Part 211, analytical method validation for quality testing, and computer system validation where applicable. The validation elements include Installation Qualification lasting two to three weeks, Operational Qualification requiring three to four weeks, Performance Qualification lasting four to six weeks, and Continued Process Verification on an ongoing basis.

EU standard validation follows EMA guidelines with more comprehensive risk-based approaches. Documentation requirements include equipment qualification per EMA guidelines, process validation following ICH Q8, Q9, and Q10 guidelines, risk-based validation approach implementation, and quality management system integration. EU standards typically require more comprehensive risk assessment documentation, statistical process control implementation, advanced process monitoring requirements, and international regulatory coordination.

Change Control Procedures

Standard migration requires comprehensive change control addressing technical changes including equipment specifications and capabilities, process parameters and control ranges, quality attribute acceptance criteria, and analytical method modifications. Regulatory submissions may require Prior Approval Supplements for significant changes, comparability protocols for demonstration of equivalence, post-market surveillance and reporting requirements, and international regulatory notification procedures.

The complexity of change control often exceeds the complexity of the technical changes themselves, requiring careful planning and extensive documentation to ensure regulatory acceptance. Companies should engage regulatory authorities early in the planning process to ensure alignment on change control approaches and documentation requirements.

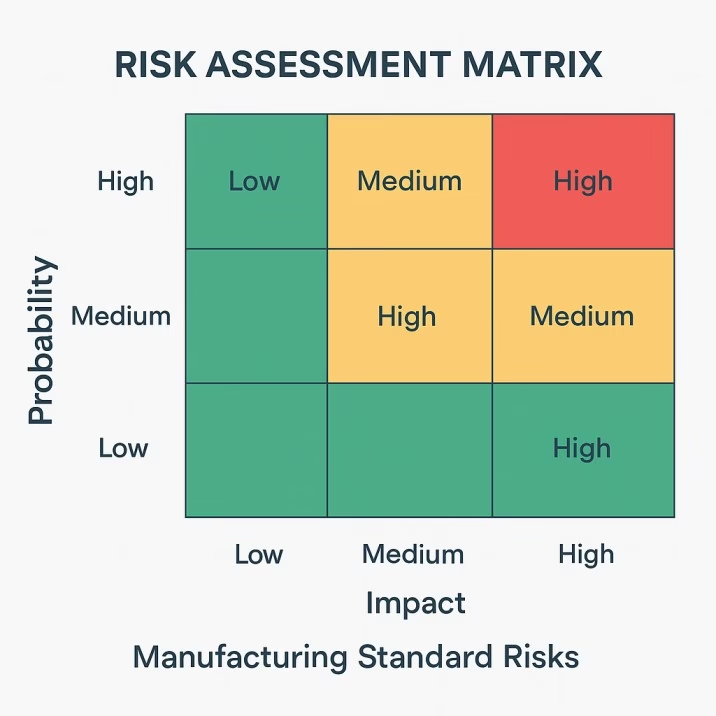

Risk Assessment and Mitigation

Technical Risk Analysis

High-risk scenarios include standard incompatibility issues that can result in tooling damage from incorrect standard usage. Mitigation requires comprehensive staff training and color-coded inventory systems, with potential impacts ranging from $50,000 to $200,000 per incident. Quality system disruption represents another high-risk scenario that could lead to regulatory compliance issues during transition, requiring extensive validation and parallel system operation to mitigate potential production shutdowns and regulatory action.

Supply chain disruption due to limited supplier availability for chosen standards requires multi-source supplier qualification and safety stock maintenance, with potential impacts including production delays and increased costs. These high-risk scenarios require proactive management and comprehensive contingency planning.

Medium-risk scenarios include staff training gaps leading to improper operation and quality issues, requiring comprehensive training programs and competency assessment to mitigate increased reject rates and rework costs. Equipment performance variability due to different performance characteristics between standards can affect product quality, requiring extended validation periods and statistical process control implementation to manage extended time to commercial production.

Business Risk Evaluation

Market access risks include regulatory approval delays where standard choice may impact approval timelines in certain markets. Companies should consider regional regulatory preferences and plan for extended approval periods when switching standards. Competitive positioning may be influenced by technology capabilities, requiring evaluation of customer preferences and requirements along with long-term strategic positioning considerations.

Financial risk management must address investment recovery risk associated with major standard changes requiring significant capital investment. Extended payback periods increase financial risk, making phased implementation approaches attractive for reducing exposure. Operating cost variability due to different maintenance and operational requirements between standards requires planning for cost optimization over equipment lifecycle periods.

Expert Recommendations and Strategic Conclusions

Based on comprehensive industry analysis and expert consultation, specific recommendations emerge for different scenarios. For new greenfield projects, EU standards are recommended due to global compatibility, superior efficiency, and future-proofing capabilities, unless operations focus exclusively on US markets with no export plans. The 10 to 15 percent investment premium for EU standards provides long-term operational advantages that justify the initial cost difference.

For US-focused operations, TSM standards remain recommended due to regulatory familiarity, supply chain optimization, and lower implementation risk when serving primarily North American markets. However, companies should monitor EU standard adoption trends for future transition planning as global standardization efforts continue.

For existing facility upgrades, strategic evaluation becomes critical. EU migration makes sense when major equipment replacement is scheduled and can be aligned with normal capital investment cycles. TSM retention may be appropriate for incremental upgrades with limited budgets, though companies should align standard decisions with major maintenance cycles to minimize total cost impact.

The pharmaceutical manufacturing industry is evolving toward global standardization, driven by supply chain efficiency and regulatory harmonization initiatives. While TSM standards will remain important for US operations for the foreseeable future, EU standards represent the future of global pharmaceutical manufacturing due to their worldwide acceptance and technological advantages.

The most successful manufacturers will be those who make informed decisions based on comprehensive analysis of their specific situations, plan for long-term strategic positioning that considers market evolution, invest in capabilities that support global market access, and maintain flexibility for future industry evolution toward greater standardization.

The choice between TSM and EU standards represents far more than a technical specification decision. It is a strategic positioning choice that will influence manufacturing capabilities, market access, and competitive positioning for decades. Companies must carefully weigh their specific circumstances, market requirements, and long-term strategic objectives when making this critical decision.

Your standard choice today will determine your competitive position tomorrow. The key is to choose wisely based on comprehensive analysis, implement thoroughly with proper risk management, and maintain the flexibility to adapt as the industry continues its evolution toward truly global manufacturing standards. Success in this decision requires understanding not just the technical differences between standards, but also their strategic implications for long-term business success in an increasingly global pharmaceutical marketplace.